Legacy Giving

Consider leaving a legacy of clean air and water; special places to hunt, hike, fish, and explore close to home; places that make Wisconsin such a wonderful place to live, work, and play.

Thank you. The fact that you even clicked on this page deserves a thank you. Your support is the reason that land and water in Wisconsin, this place you love, is conserved today. It could also be the reason it is conserved tomorrow.

Whether you are taking your first steps toward drafting your will or considering an update to your estate plan, Gathering Waters is here to help you achieve your long-term charitable goals.

Through a planned gift to Gathering Waters, you can leave a legacy of special places in Wisconsin for future generations.

First, we always recommend that you consult with a professional advisor on matters related to your estate plan.

Next, there are multiple ways to provide for yourself and your loved ones while also leaving a gift to protect Wisconsin’s land and water. Through charitable gift annuities, gifts of life insurance, remainder beneficiaries of IRA accounts, and more—we can work with you and your advisor to find the option(s) that meets all of your needs and does more than you might think is possible!

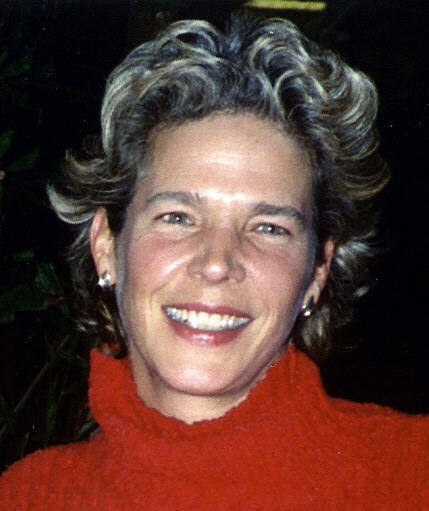

Please reach out today to have a confidential conversation about making a gift to protect land and water in Wisconsin through your will or estate plan. Please call Creal Zearing, Director of Philanthropy, at 608-251-9131 x18 or email at creal@gatheringwaters.org.

Finally, for tax ID information and recommended language to include in your will or estate plan, please download the form below.

Please consider filling out the form and returning it to us so that we may thank you during your lifetime for your gift. Having a copy on file at Gathering Waters adds an extra layer of protection that your gift will be carried out as you planned.

Types of Planned Gifts

We encourage you to discuss which giving option best fits your needs with your financial planner or estate planning attorney. Types of gifts you may consider include:

- Bequest in a will

- Life insurance

- Charitable gift annuities

- Retirement plan or IRA beneficiary designation

- Charitable remainder trust

- Insurance beneficiary designation

- Gift or real estate or other tangible property

Recommended Estate Language

To make a planned gift, we recommend the following language:

Gifts for General Charitable Purposes

- I/we give to Gathering Waters, Inc. (tax ID# 39-1805090), currently located in Madison, Wisconsin (or successor organization), ___________% of my residual estate to be used for its general charitable purposes.

- I/we give to Gathering Waters, Inc. (tax ID# 39-1805090), currently located in Madison, Wisconsin (or successor organization), the sum of $___________ to be used for its general charitable purposes.

Gifts for Specific Purposes

- I/we give to Gathering Waters, Inc. (tax ID# 39-1805090), currently located in Madison, Wisconsin (or successor organization), ___________% of my residual estate to be used for __________________ (specific purpose).

- I/we give to Gathering Waters, Inc. (tax ID# 39-1805090), currently located in Madison, Wisconsin (or successor organization), the sum of $___________ to be used for _____________________(specific purpose).

A Special Thank You...

Jim Bennett

Dana & Pat Chabot

Sean & Sara DeKok

Michele Parker

Eric Forward

Kreitz Living Trust

Tim Jacobson

Sarah Perry

Harold “Bud” Jordahl

Dale & Joanna Kramer Fanney

Tia Nelson

Dale Druckrey Conservation Fund of the National Resources Foundation

Anonymous